Let’s be honest. The old way of farming is under immense pressure. You’ve got climate chaos throwing curveballs, a ballooning global population, and frankly, a finite amount of arable land. It’s a perfect storm. But here’s the deal: where there’s a major problem, there’s often a major investment opportunity. That’s where thematic investing in smart agriculture and controlled environment food production comes in.

This isn’t just about buying tractor stocks. It’s about investing in the entire technological ecosystem that’s radically reimagining how we grow our food. Think of it as backing the architects of the next green revolution—a revolution powered by sensors, software, and sunlight delivered on demand.

Why Thematic Investing Makes Sense for AgTech

Thematic investing cuts across traditional sectors. You’re not just looking at “industrials” or “tech.” You’re following a powerful, unstoppable trend. And the trend here is clear: we must produce more food with less—less water, less land, less waste. That’s a multi-decade tailwind.

It’s about connecting the dots between urgent global needs and the companies providing the solutions. From the software that tells a farmer the exact moment to irrigate, to the robotics that harvest strawberries in a vertical farm, the value chain is deep and interconnected.

The Core Pillars of a Smart Agriculture Portfolio

1. Precision & Data-Driven Farming

This is the brains of the operation. Imagine fields bristling with IoT sensors, drones mapping crop health, and AI analyzing decades of weather patterns. This pillar is all about optimization.

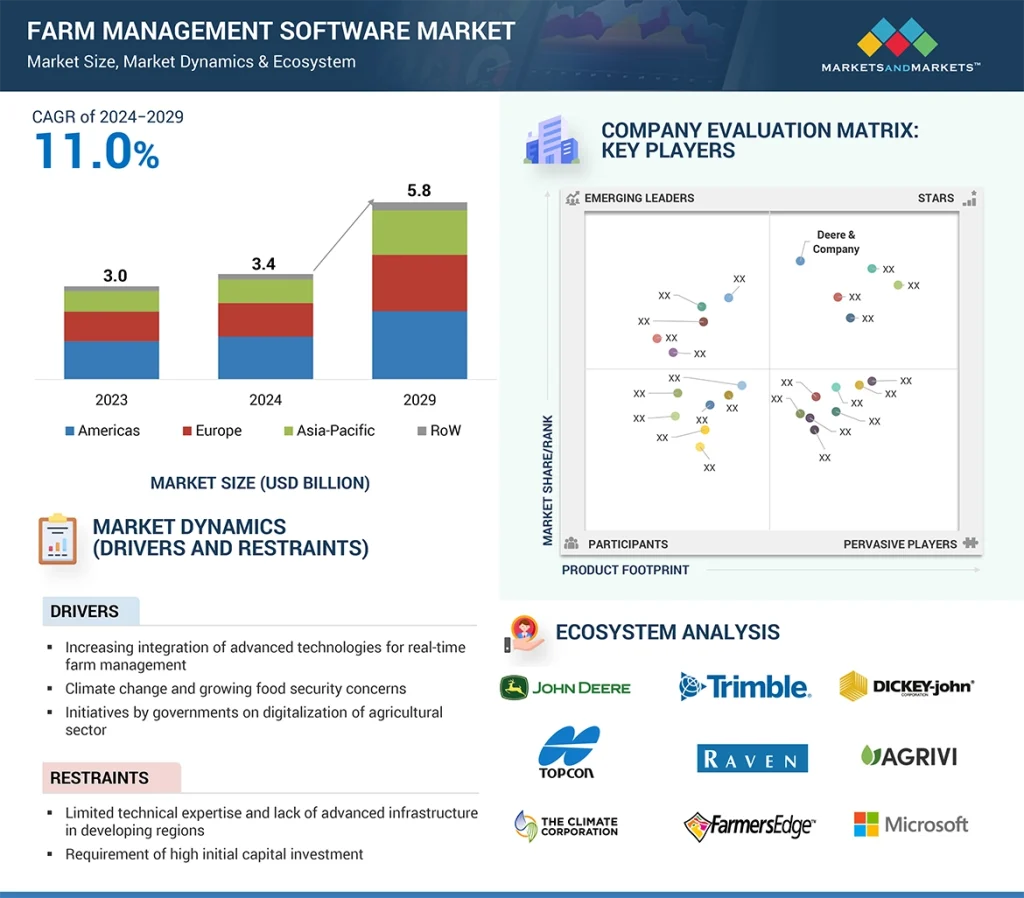

- Key Tech: GPS-guided equipment, variable-rate technology (applying seed, fertilizer, and water at precise rates), drone-based scouting, farm management software platforms.

- The Investor Angle: Look at companies making the sensors, the analytics software, and the integrated hardware that turns data into actionable insights. It’s efficiency as a service.

2. Controlled Environment Agriculture (CEA)

This is perhaps the most visceral shift. We’re moving food production indoors—into warehouses, shipping containers, and high-tech greenhouses. It severs the traditional link between food, climate, and geography.

Vertical farms stack growing trays, using LED lights tuned to specific plant recipes. Advanced greenhouses use automated climate control and often soilless systems like hydroponics or aeroponics. The benefits? Massive water savings, zero pesticides, year-round local production, and dramatically reduced food miles.

3. Biologicals & Sustainable Inputs

The move away from harsh chemical fertilizers and pesticides is accelerating. The new tools are biological. We’re talking about microbial seed coatings that boost plant health, natural pest predators, and fertilizers derived from algae or other organic sources.

This is a huge growth area because it aligns with both regulatory pressure and consumer demand for cleaner food. It’s a direct play on the decarbonization of the supply chain.

4. Automation & Robotics

Labor shortages are a chronic pain point. The answer? Robots. From autonomous tractors tilling vast fields to delicate robotic arms that can identify and pick ripe produce in a CEA facility, automation is filling the gap.

This isn’t about replacing people wholesale; it’s about augmenting human effort and taking over the most back-breaking, repetitive tasks. The companies building these specialized machines—and the vision systems that guide them—are critical.

Mapping the Investment Landscape: A Quick Guide

So, how do you actually get exposure? Well, the ecosystem is diverse. You can think of it in layers, from pure-play innovators to established giants pivoting into the space.

| Category | What It Includes | Investment Consideration |

| Pure-Play Innovators | Public & private vertical farming companies, specialized AgTech SaaS platforms, robotics startups. | Higher potential growth, but also higher risk and volatility. Often not yet profitable. |

| Diversified Tech & Industrial Giants | Companies providing essential hardware (LEDs, sensors, climate systems), automation, and industrial gases for CEA. | More stable, established revenue. AgTech may be a growing segment within a larger, diversified business. |

| Agricultural Inputs & Bioscience | Traditional ag companies with strong biologicals divisions, seed science firms using gene editing for resilience. | Blend of old and new. Offers a way to invest in the transition. |

| ETFs & Funds | Thematic ETFs focused on AgTech, Food Tech, or Sustainability. | Provides instant diversification across the theme. Simplifies access but dilutes pure-play exposure. |

The Real-World Challenges (It’s Not All Green Shoots)

Okay, let’s pause for a reality check. This sector is exciting, but it’s not without its thorns. Energy consumption, especially for vertical farms using artificial light, is a major cost and sustainability question. The capital expenditure for building high-tech CEA facilities is enormous.

And, you know, scaling from a successful pilot to a profitable, mass-scale operation has tripped up more than one promising startup. As an investor, you need to look for companies with a clear path to unit economics that make sense—where the cost to grow a head of lettuce is truly competitive with the field-grown alternative, accounting for all inputs.

Planting the Seeds for a Long-Term View

Thematic investing in smart agriculture requires patience. This is infrastructure being built in real-time. It’s a long-term bet on demographic, climatic, and technological convergence.

The most compelling part? This isn’t a speculative tech trend in search of a problem. The problem—how to feed 10 billion people sustainably—is starkly real. The solutions we’re talking about here are direct answers. They may just represent one of the most consequential, and potentially rewarding, investment themes of our lifetime. It’s about putting capital to work not just for returns, but literally, for growth.